We can now provide Tax Invoices to your customers for all fulfillment types!

HungryHungry can now assist with providing your customers with Tax Invoices for any and all types of orders! Moving forward, Tax Invoices can be sent via email for:

- Pick-Up

- Delivery

- Drive-Up

- Order@Table

- Collect@Counter

- Room Service

For us to configure this for your venue, we will need you to send your ABN (Australian) or GST Number (New Zealand) to the team. Without this information, we won't be able to proceed and your customers will simply receive an order confirmation via email.

The HungryHungry team will need to assist you in enabling this, so please reach out!

Once Tax Invoices have been enabled for your venue, all of your customers will receive a Tax Invoice via email once their order has been paid and processed.

The Tax Invoice will be included in their order confirmation.

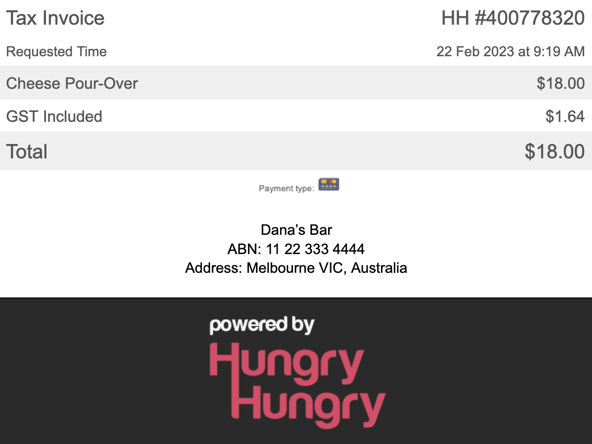

Here is an example below:

Finding the Customer's Tax Invoice

Customers can easily find their tax invoice by searching their email inbox for the original order confirmation.

If the customer can't find the email, try these steps:

- Check their Spam/Junk folder.

- Search for "HungryHungry" from within their email account

- Confirm that the email address they’re checking matches the one used to place the order.

- Typos can happen!

- Sometimes the email address used to place the order is not the same email account they are searching (e.g. business vs. personal accounts)

If they still can't locate it, or if you'd like our team to assist, feel free to reach out—we’re happy to help! 😊

Want to learn more or have feedback for us? Say hello!

💬 CHAT: Chat with us online! You can find our ChatBox, 'Dave' in the bottom right-hand corner of our website.

📞 PHONE: AU +61 3 7036 0754 / NZ +64 4 831 9400

🗒️ Form Submission: https://help.hungryhungry.com/kb-tickets/new

✉️ EMAIL: help@hungryhungry.com